liveLive updates: Nikkei hits record high 34 years after bubble popped, ASX flat amid profits for Qantas, Medibank and many more

Nearly three-and-a-half decades after a catastrophic crash wiped out the Japanese asset bubble, its stock market has finally hit a record high. But the ASX is not following, amid a raft of mixed profit results.

Former treasurer Peter Costello and two ex-RBA governors urge parliament not to ditch the government's to-date unused power to override Reserve Bank actions.

We'll bring you the latest on what's happening on the markets throughout the day in our live blog.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapshot

By Michael Janda

- ASX 200: -0.1% to 7,601 points

- Australian dollar: -0.4% to 65.45 US cents

- Nikkei: +1.5% to 38,820 points

- Hang Seng: -0.3% to 16,447 points

- Shanghai: -0.1% to 2,947 points

- S&P 500: +0.1% to 4,982 points

- Nasdaq: -0.3% to 15,581 points

- FTSE: -0.7% to 7,663 points

- EuroStoxx: -0.2% to 491 points

- Spot gold: -0.2% at $US2,027/ounce

- Brent crude: +0.4% to $US82.98/barrel

- Iron ore: -1.5% to $US119.00/tonne

- Bitcoin: -0.9% to $US51,380

Prices current around 1:25pm AEDT

Live updates on the major ASX indices:

Tokyo's Nikkei share index finally surpasses 1989 record high

By Michael Janda

Japan suffered one of the worst developed economy asset crashes in history after its stock and property bubbles peaked at the end of the 1980s.

Finally, after more than 34 years, the Nikkei share index has surpassed the highs it reached during that bubble.

Tokyo's benchmark stock index hit an intraday high of 39,029 earlier this afternoon, passing the previous record set of 38,957 points set on the last trading day in 1989, according to Reuters.

The 34 years that the Nikkei took to recover its losses is a record for developed economy markets, and a decade longer than Wall Street took to recover from the depths of its stock crash during the Great Depression.

Continued zero interest policies from the Bank of Japan, that have pushed the yen down to multi-year lows against many major currencies, plus corporate governance changes that have seen an increase in share buybacks have contributed to the recent gains.

The Nikkei's record comes despite recent confirmation that Japan's economy was in a technical recession — two consecutive quarters of economic contraction — over the second half of 2023.

Copper's share price riding a wave of (green) power, say ANZ analysts

By Michael Janda

Copper demand and prices have typically been a good barometer for economic activity and the outlook.

But ANZ commodity analysts Daniel Hynes and Soni Kumari say it beaten expectations amid an uncertain economic backdrop.

They attribute that to the electrification trend that's seeing growing demand for wires … made of copper.

"Copper has a broad spread of consumption across the global economy, leading to concerns over demand amid tighter monetary policies and weaker economic growth," they note.

"However, it's remained strong amid an increased focus on electrification and decarbonisation. We expect growth in demand from China, US and India, three of the top five consumers, to reach 4.3% in 2024.

"This comes amid increasing supply side issues. Unplanned disruptions are likely to remain high as producers struggle with high costs and falling quality issues. Political risks also remain high, putting new mine development at risk.

"We see the market returning to deficit this year, which should underpin prices. We maintain our short-term target of USD9,000/t and expect that to lift above USD10,000/t over the next 12 months."

Copper was selling for $US8,495 a tonne this morning.

Fortescue raises dividend after 41 per cent jump in profits

By Michael Janda

Getting to some other interesting profit results now that we didn't have time to look at during the Qantas frenzy of this morning.

Fortescue Metals Group has come through with a substantial 41% jump in first-half profits to $US3,337 million ($5,093 million).

That came off a 21% rise in revenue to $US9,512 million ($14,517 million).

The miner shipped 94.6 million tonnes of iron ore from Western Australia, 2% down from a record first half set last year.

However, it kept cost increases to just 2% while booking a 24% increase in average revenue to $US108.19 per dry metric tonne.

However, analyst Lachlan Shaw from UBS warned that significant price falls since China came back from the lunar new year holiday week present a risk to the sustainability of this level of earnings.

"Strong H1-FY24 on elevated iron ore prices and tight discounts, although iron ore down >7% 1wk to US$120/t weighing on stock," he noted.

"Maintenance of FY24 shipment guidance of 192-197Mt despite soft January shipments on weather and train derailment does increase dependence on strong 2H/Jun-Q shipments. This is not unusual seasonally but we will need to monitor for disruptions over coming months."

Fortescue has announced a $1.08 per share fully-franked interim dividend, up from 75 cents last year (both in Australian dollars).

Its share price was up 1.3% to $27.60 by 2:40pm AEDT.

Committee hearing has ended

By Gareth Hutchens

But with that, the senate hearing has finished for today.

Thanks for sticking with me on that.

What is Section 11?

By Gareth Hutchens

What is section 11 of the overrule act please explain

- David-W

Hi David,

It's a section in the Reserve Bank Act 1959.

It provides the federal treasurer with the power to overrule a decision by the Reserve Bank in extreme circumstances.

It's supposed to be a democratic fail-safe.

In the Senate hearing today, economic historian John Hawkins reminded senators that this overrule power has an important political history.

He said in the 1930s, the Commonwealth Bank (the predecessor to the Reserve Bank) exacerbated the Great Depression by refusing to help James Scullin's Labor government to fund public works to boost employment and to provide relief to farmers.

That behaviour by the central bank during the Depression was not forgotten by Labor, and it's why Labor prime minister Ben Chifley enshrined the overrule power in the Commonwealth Bank Act of 1945, to ensure that Australia's government would always have ultimate power over the bank in the future.

Prime minister Robert Menzies then enshrined that power in the updated Reserve Bank Act 1959.

Mr Hawkins said no government has ever had to use that overrule power since it was put into the act, but it's seen as a democratic fail-safe to ensure that the federal government retains the power to pull the bank into line if necessary.

And as economic historian Alex Millmow has previously said, it's ironic that Labor Treasurer Jim Chalmers has accepted the recommendation to strip that power from the act, when it was a Labor government that put the power into the act in the first place (in the 1940s) in a direct response to Australia's central bank going rogue during the 1930s depression, for which the then-Labor government of James Scullin suffered politically.

Treasury officials defend RBA Reviewers for recommending parliament dump the overrule power

By Gareth Hutchens

Treasury officials are now appearing before the committee.

Luke Yeaman, Deputy Secretary macroeconomic group, has provided some defence for the RBA Review panellists after they recommended the overrule power be stripped from the RBA Act.

He says the international experience is important on this matter.

He says it's not common overseas for governments to have an override power with regard to their central banks.

"The EU, Japan, New Zealand, the US and Sweden all don't have override powers, so I think that was considered by the review to be keeping with best practice overseas," he said.

He said the recommendation to strip the overrule power from the Act was partly about future-proofing the independence of the Reserve Bank.

Greens senator Nick McKim says there were 114 submissions to the RBA Review, but only 78 were made public.

He says amongst those 78 public submissions, none of them recommended that Section 11 should be removed from the Act.

Treasury official Shane Johnson says the submission from Andrew Levin did not specifically reference Section 11 in the RBA Act, but it did talk about override powers and best practice generally.

RBA governor Michele Bullock says the RBA has not lobbied for the overrule power to be removed

By Gareth Hutchens

RBA governor Michele Bullock is now appearing before the committee via videolink.

She says she's "agnostic" on the proposal to strip the government's overrule power from the RBA Act.

She says it's a matter for the government and parliament to decide how they want to proceed on this matter.

She said she didn't expect the topic of the overrule power to come up in the RBA Review.

She said the RBA had enough independence to do its job already.

Greens senator Nick McKim is pushing Governor Bullock to give a firmer opinion on her view of the recommendation to strip the overrule power from the Act. Ms Bullock says she can see both sides to the argument.

Mr McKim asks if Section 11 were removed from the Act, how would a serious disagreement between the RBA and government be resolved?

Ms Bullock says should doesn't know what would happen if the RBA and government couldn't agree about something. She says she'd try to talk to the government and resolve the disagreement, but if no resolution could be found she's not sure what would happen. She says she doesn't know what the legal ramifications might be in that situation.

She throws the question to her general counsel whom says a formal legislative mechanism of some kind could be created to solve the issue.

Mr McKim asks, isn't that what Section 11 already provides?

Ms Bullock says yes, that's what Section 11 does now.

Paul Keating agrees with Peter Costello that RBA overrule power should be retained

By Michael Janda

The Senate has today heard from two former RBA governors (Bernie Fraser and Ian Macfarlane) and a former treasurer (Peter Costello) urging parliament to retain the government's power to overrule the Reserve Bank as outlined in the current Section 11 of the RBA Act.

The RBA review, which reported last year, recommended removing the overrule power, even though no Australian government had used it in the more than 60 years it has existed.

But Peter Costello isn't the only former treasurer who thinks ditching the power, which comes with accountability to the parliament if exercised, is a bad idea.

Gareth Hutchens, who is covering today's hearing, discussed the issue with former treasurer and prime minister Paul Keating last year.

"Political power, its management and employment in office, must, in a working democracy, take precedence over any subordinate bureaucratic structure. As the political power is itself subordinated to the community at large," Mr Keating argued.

You can read more of what he said, including about the time he considered using the power, in Gareth's article.

RBA reviewers justify their recommendation to strip the overrule power from the RBA Act

By Gareth Hutchens

Professor Renee Fry-McKibbin was one of the experts who reviewed the RBA.

She is now appearing before the committee, along with fellow reviewer Dr Gordon de Brouwer.

Professor Fry-McKibbin has run senators through the list of things that some previous witnesses have spoken about today.

In her opening statement, she only briefly mentioned the hot topic of the overrule power, which she has recommended be stripped from the Act.

She said "the parliament is sovereign" and it could always overrule the RBA in the future (we're assuming, here, that the overrule power has already been stripped from the Act) by amending the Act again.

Dr Gordon de Brouwer said he thinks it would be better for parliament to override the central bank, rather than the executive government, and the current arrangements give too much power to executive government.

Liberal senator Andrew Bragg wants to know how the government of the day, in a world where the overrule power has been stripped from the Act, could prevent the RBA from going rogue and lifting interest rates to 20%.

Dr de Brouwer says the elected government, in that situation, could reflect its concerns in a new bill that it could try to pass through parliament. He says the changes he has recommended making to the RBA's governance would make the RBA a "highly competent" organisation where it was even less likely to go rogue.

Senator Bragg wants to know if they think the RBA is independent now, even though Section 11 is in the Act. Dr de Brouwer says it is independent.

Liberal senator Dean Smith wants to know if the reviewers can name any people, as equally esteemed as people like Peter Costello, Ian Macfarlane, and Bernie Fraser, who are arguing for the overrule power to be stripped from the Act.

Professor Fry-McKibbin says Professor Andy Levin from the US wrote an in-depth paper on this point. She said there's also a lot of academic work looking at the inflation shocks of the 1970s which found that the more independent central banks are, the better they performed in that period.

Greens senator Nick McKim says he's struggling to understand where this recommendation to dump the overrule power from the Act has come from. He says current RBA governor Michele Bullock is "agnostic" on the idea, and we've just heard from former RBA governors Ian Macfarlane and Bernie Fraser, and Peter Costello, that the power should not be stripped from the Act.

Dr de Brouwer says it wouldn't be the end of the world if the power stayed in the Act, but he has still recommended dumping it.

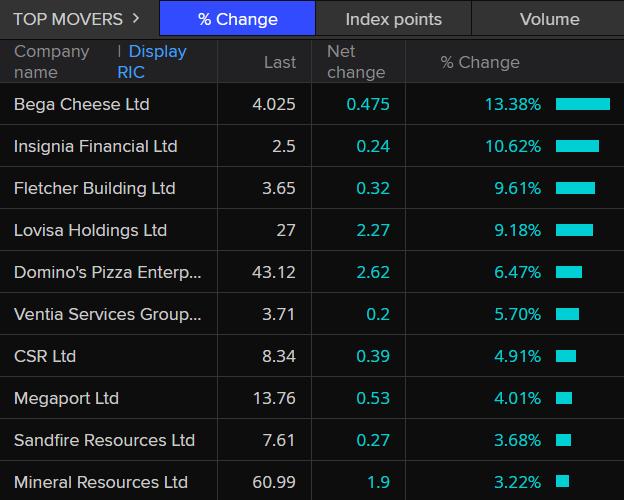

ASX flat as banking losses offset broader gains

By Michael Janda

The benchmark ASX 200 index was up 0.1% at 7,616 points by 12:37pm AEDT.

The financial sector was down about a quarter of a per cent, with real estate stocks down half a per cent.

The big four banks were all down, but only modestly, with falls between 0.3 and 0.5%

Utilities (+1.1%), healthcare (+0.6%), consumer non-cyclicals (+0.5%) and energy (+0.5%) were the leading sectors.

But the big cheese on today's market is Bega — sorry for the cheesy pun ;) — which was up 13.5% to $4.03 on its latest profit results.

The company's share price is now closing in on E&P Capital retail analyst Phillip Kimber's $4.05 target price.

"A better than expected EBITDA result, strong performance in the Branded business (EBITDA +123%) and reconfirmation of both FY24 and medium-term guidance is positive," he noted.

"BGA's share price performance leading into the result has been strong, rallying ~30% from late CY23. We expect the result (subject to comments on the conference call) to continue to support the share price, noting 10% higher EPS for VA consensus in FY25 implies a PE of ~23x.

"As we have previously noted, BGA still offers valuation upside if it can deliver on its 5-year plan, and as such provides an opportunity for investors with longer term investment timeframes. As always, June will be an important period as farmgate milk pricing is set for the FY25 season."

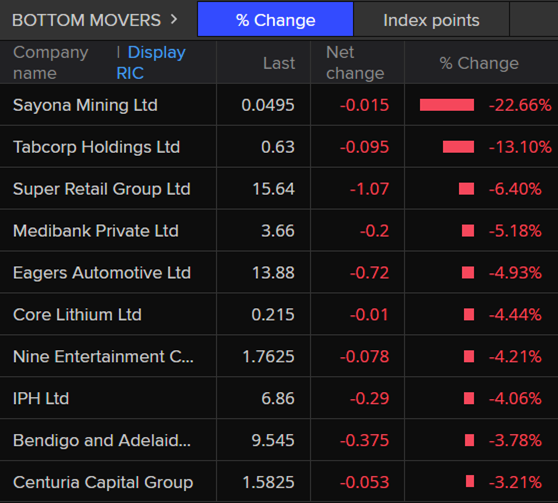

There have also been plenty of big losers on the market today as company profit reports continue lobbing in apace.

Former RBA governor Bernie Fraser says overrule power must stay in the RBA Act

By Gareth Hutchens

Mr Costello has finished giving evidence at the hearing.

Former RBA governor Bernie Fraser has just replaced him.

Mr Fraser says he agrees with Mr Costello and Mr Macfarlane that the overrule power should not be stripped from the RBA Act.

In his submission to the hearing, he warns against it in some detail.

"Simply dumping Section 11 would do nothing to enhance the Bank’s independence," he wrote.

"Rather, the likelihood is that, sooner or later, the vacuum would be filled with alternative processes aimed at clipping the Bank’s independence."

Aussie dollar highest against yen in nearly a decade, Nikkei above record closing high

By Michael Janda

With airfares apparently falling, is it time for a holiday?

IG's Tony Sycamore says recent currency moves make Japan look like a particularly appealing destination.

"With risk assets on the rise, following Nvidia's bumper earnings result this morning, the AUD/JPY cross rate has been a beneficiary, trading to a high of 98.65, its highest level since December 2014.

"What better time to start planning the next holiday in Japan."

The yen is being held down as the Bank of Japan remains a singular hold out on zero interest rate policy.

In fact, its benchmark rate on bank balances held at the BOJ is -0.1 per cent and it is still buying bonds in the market with an aim to keep 10-year interest rates below 1 per cent.

Most central banks are selling bonds, or at least letting them mature without buying up more.

Japan's standout low monetary policy, despite an increase in inflation there (albeit way below most developed economies) has depressed its currency.

A weak yen has not only been great for tourists who want to visit, but also for Tokyo's stock exchange, with the Nikkei very close to record highs set in 1989 (yes, that's right, 1989) just before its share and property markets imploded into the lost decade(s).

In fact, a few minutes ago, the Nikkei traded above its record closing high from 1989, and is within a handful of points of the record intraday high.

More importantly, can someone tell me when Japan's ski season ends???

LoadingHudson reflects on leadership transition as Qantas gets used to life after Joyce

By Michael Janda

For 15 years, much of Qantas' image revolved around one man — its now former chief executive Alan Joyce who left in early September, a couple of months before his scheduled departure.

Now the pressure is on his successor Vanessa Hudson, the company's former chief financial officer, who's cautiously putting her own stamp on the airline, delivering a 13 per cent decline in half-year profit.

The ABC's senior business correspondent Peter Ryan caught up with Ms Hudson at a special event at Sydney Airport this morning to discuss life after Joyce at Qantas, including some of the legal challenges still hanging over the airline from his time in charge.

Former treasurer Peter Costello says overrule power needs to stay in the RBA Act

By Gareth Hutchens

Mr Macfarlane's evidence has finished.

Former treasurer Peter Costello has stepped into the hot seat.

Mr Costello says he's not quite sure why the RBA Review has recommended splitting up the current RBA Board structure.

He says if we had two RBA boards — one looking after monetary policy, and one looking after the Bank's balance sheet — then it could actually worsen the bank's governance.

On the matter of stripping the overrule power from the act, he says he doesn't think it should happen.

"I don't think we'll improve things by getting rid of it," he said.

He says the federal parliament needs to maintain ultimate power over the RBA, and it would be strange to see parliament voting to get rid of that power.

"It's such a difficult power to exercise that the government could only exercise it in extreme circumstances, which is why it's never been done," he said.

"Which is why, in my view, it's not a problem."

He said he actually thinks that central banks don't get enough scrutiny, and they're already so powerful that the press should be even more robust in their criticism of central bankers.

Medibank's data breach continues to cost the company in more ways than one

By Michael Janda

From my colleague Ange Lavoipierre, who has just moved into a new role as the ABC News national technology reporter:

The 2022 Medibank data breach is continuing to hurt the company's bottom line, 16 months on.

More than 9 million customers had their names, birth dates, Medicare numbers and sensitive health information stolen in October 2022, and in some cases, sold on the dark web.

The 2024 half yearly report shows a cost of $17.6 million so far, with a projected hit of between $30 million and $35 million over the full year — mostly spent on legal costs and beefing up cyber-security.

However, this number doesn't include any potential class action payouts or regulatory fines.

Still, it's less than 2022/23, when the incident response and customer support package came to $46.4 million.

Hopefully you'll be hearing a lot more from Ange in this blog and across the ABC as she covers the biggest stories in the hugely important tech sector.

How to watch the Senate committee

By Gareth Hutchens

If you're keen to watch this Senate hearing, click on the link below.

It will direct you to this hearing: Senate, Economics Legislation Committee (-Treasury Laws Amendment (Reserve Bank Reforms) Bill 2023).

Former RBA governor Ian Macfarlane says overrule power needs to stay

By Gareth Hutchens

Former RBA governor Ian Macfarlane has just started giving evidence at the hearing.

He also says that it would be a "big mistake" to remove the government's overrule power from the Reserve Bank Act.

He's told senators that "after decades of reflection" he's concluded that that overrule power — which is found in Section 11 of the Act — was a very valuable thing to have in a democratic society.

He says it has never been used, but that doesn't mean it's redundant. He says it needs to stay in the act for rare events.

He says Section 11 actually "protects central bank independence".

Liberal senator Andrew Bragg asks Mr Macfarlane why he thinks the RBA reviewers have recommended that the overrule power should be stripped from the act, and Mr Macfarlane laughed.

"I don't know," he then replied.

"I don't think there's been big thinking behind the decision to get rid of Section 11," he said.

The Reserve Bank and the government's 'overrule' power

By Gareth Hutchens

You may remember, but the three panellists who reviewed the Reserve Bank made a controversial recommendation.

They said there was a power written into the Reserve Bank Act 1959 that granted the federal treasurer the power to "overrule" an action taken by the Reserve Bank in extreme situations, and that overrule power should be removed from the act.

Their reasoning was that there was a risk that the federal treasurer, and by extension the federal government, might abuse that power.

But we've heard from multiple witnesses today that they don't agree with that recommendation.

Economic historian John Hawkins said it would be undemocratic to strip that overrule power from the treasurer.

Economist Steven Hamilton agreed with Dr Hawkins, as did economists Richard Denniss and Matt Grudnoff from the Australia Institute think-tank.

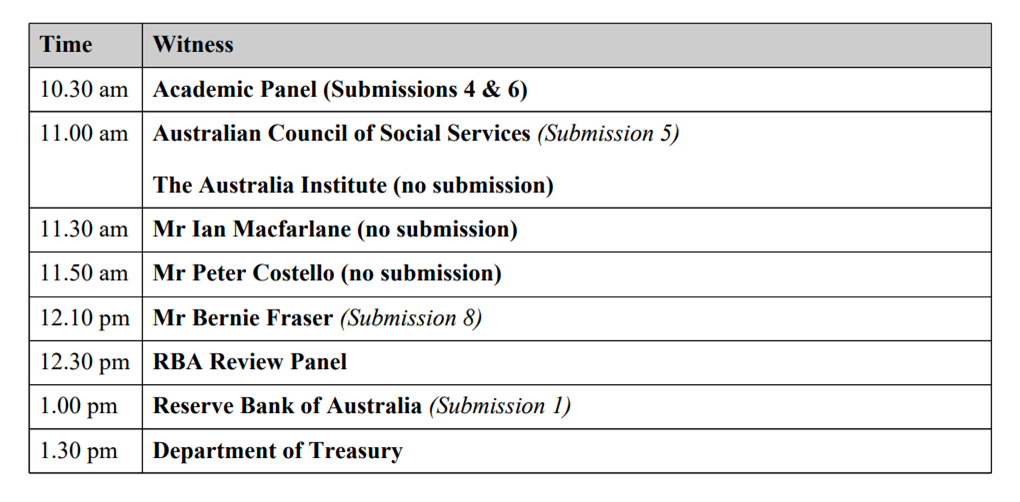

Senate hearing on recommended changes to Reserve Bank governance

By Gareth Hutchens

Good morning everyone.

I'll just draw your attention to an interesting Senate committee hearing that began at 10:30am AEDT.

The committee is looking at the Reserve Bank Reforms Bill 2023, which will amend the Reserve Bank Act 1959.

This has to do with last year's review of the RBA, which recommended that a number of changes be made to the RBA's governance structure, its public communications and its monetary policy meetings.

We'll be hearing from former RBA governor Ian Macfarlane very shortly.

He'll be followed by former treasurer Peter Costello, former RBA governor Bernie Fraser, and RBA and Treasury officials.